CTR Project Update

Dear Friends of CTR,

The first half of 2025 has been an exceptionally busy and productive period for Controlled Thermal Resources. The momentum is accelerating across execution, permitting, capital, and policy, culminating in what is now a clear turning point for CTR and the Hell’s Kitchen Project.

Simply put, CTR’s multiple strategic resources are precisely what the United States needs at this pivotal time. Federal agencies, senior administration officials, and development partners increasingly recognize that execution is now the highest priority. The country urgently requires projects that are permitted, resourced, and ready to build - and CTR is one of the only fully integrated projects that is essentially ‘shovel-ready’ and capable of producing baseload renewable power and critical minerals from a single site.

The policy shift underway in Washington is unmistakable. The recently enacted ‘One Big Beautiful Bill Act’ (OBBBA) directs incentives and funding allocations toward projects that can deliver domestic baseload energy security, critical minerals, manufacturing capacity, and supply chain resilience.

We are actively engaged to advance multiple federal funding and incentive programs now being repurposed to support this national strategy:

Tax and investment incentives under the OBBBA for geothermal power and critical minerals.

Department of Defense programs under the Defense Production Act targeting secure domestic sourcing of lithium and strategic minerals.

Department of Energy Loan Programs Office support for baseload power infrastructure, battery-grade lithium, and downstream integration.

Export-Import Bank (EXIM) and other sovereign finance institutions providing coverage for long-lead procurement and strategic equipment.

For years, U.S. energy and minerals policy relied heavily on tariffs to shield domestic producers from foreign competition. But tariffs can only be effective if the U.S. can scale the production of these resources at home. CTR offers a solution, not just to reduce dependence on China and other nations, but to replace it with a resilient, American-controlled supply chain.

While the pivot toward geothermal energy and supply chain security gained significant traction in the first half of 2025, persistent price volatility in the lithium sector continued despite strong long-term demand forecasts. Unlike ‘pure play’ resource developers, CTR had the agility to respond strategically and decisively to these dynamics.

We have been working diligently with development partners and interested parties to unlock CTR’s multiple strategic resources, creating a highly resilient structure and execution pathways to maximize the company’s resource assets.

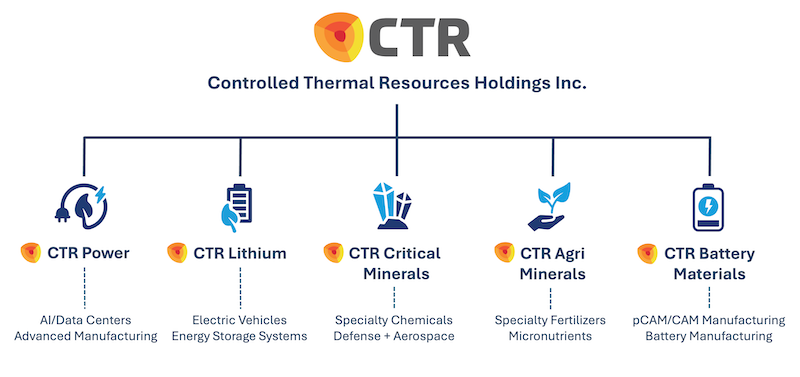

By restructuring investment optionality for each of our high-value resources, we have widened the aperture to attract specialized development partnerships and investors across CTR’s five strategic resource divisions.

CTR Power

CTR is advancing a Final Investment Decision for its Stage 1 - 50MW project.

Planned staged expansion up to 500MW is under development to support U.S. hyperscale data center growth and advanced battery manufacturing with the capacity to accommodate behind-the-meter, direct-source baseload power, bypassing grid interconnection delays.

According to Goldman Sachs, global data center power demand is projected to rise by over 160% by 2030, increasing from approximately 55,000 MW today to more than 143,000 MW, with more than 60% requiring dedicated 24/7 baseload capacity.

CTR Lithium

CTR is advancing a Final Investment Decision for its Stage 1, with an annual production capacity of 25,000 metric tons of lithium hydroxide.

Planned staged expansions are in development for the annual production of up to 175,000 metric tons of lithium products.

Demonstration and pilot programs with technology partners have de-risked project execution, positioning CTR Lithium as a globally competitive asset anchored in U.S. supply chain resilience.

According to Benchmark Mineral Intelligence, lithium demand is predicted to surge fivefold by 2040, requiring approximately 4 million new metric tons of lithium – that’s equivalent to 130 new mines producing 30,000 metric tons LCE each.

CTR Critical Minerals

CTR is engaged with potential specialist development partners and investors to unlock additional critical minerals, including boron, strontium, rubidium, cesium, and sodium.

These minerals have vital applications across various sectors essential to national security, including defense and aerospace.

The U.S. imports over 75% of its requirements for 31 of the 35 critical minerals. This dependency on foreign sources puts the U.S. in a compromised position, especially from potential adversaries who control supply.

The U.S. also lacks sufficient domestic processing capabilities for many critical minerals, making it vulnerable to external control over the refining stages of the supply chain.

Sourced from: Idaho National Laboratory - Rare earth elements in the CTR’s Salton Sea geothermal brine, May 2023

CTR Agri Minerals

CTR has identified potash (KCl) in abundant quantities in its geothermal brine.

CTR has initiated collaboration with leading global producers of specialty fertilizers, including potassium nitrate, water-soluble NPKs, controlled-release fertilizers, and micronutrients.

The U.S. is highly reliant on foreign countries for its potash supply, with approximately 93% of its demand met by imports, predominantly from Canada. Domestic potash production accounts for less than 1% of total U.S. demand. This reliance creates vulnerabilities in the U.S. agricultural supply chain, particularly given the importance of potash for corn and soybean production, the nation's two largest crops.

CTR Battery Materials

CTR is advancing discussions with a top-tier battery manufacturer and global cathode and precursor producers seeking to potentially establish a vertically integrated battery materials and assembly facility at the Hell’s Kitchen site.

The company is currently reviewing detailed economic models and U.S. supply chain incentives to assess feasibility.

The integration provides tariff insulation, secure domestic sourcing, and strategic proximity to automakers—an unmatched advantage in the current market.

Global cathode active material (CAM) production capacity is projected to grow by 178% between 2024 and 2030, according to Benchmark Mineral Intelligence. The bulk of this capacity is located in China, with the country accounting for 87% of the total capacity in 2024.

Hell’s Kitchen Stage 1 Project Update

The CTR operations team is fully engaged with development partners to advance CTR's work streams to reach a Final Investment Decision and commence Stage 1 construction.

CTR continues to make progress on the permitting front, aligning regulatory milestones with federal stakeholder engagement to support streamlined execution.

FAST-41 Designation and Federal Permitting Acceleration

On June 18, Hell’s Kitchen formally received a Fast-41 Covered Project designation by the Federal Permitting Improvement Steering Council (Permitting Council).

Hell’s Kitchen is now placed on the federal permitting dashboard, triggering significant interagency coordination and enforceable permitting timelines.

FAST-41 designation affirms Hell’s Kitchen as a nationally strategic project within the U.S. clean energy and critical minerals agenda, unlocking this coordinated agency support.

Federal Support for Domestic Baseload Energy and Critical Minerals Production

CTR, in conjunction with our strategic partners and consultants, recently conducted a series of high-level meetings in Washington, DC. These meetings confirmed CTR’s alignment with national priorities.

In addition to attractive tax incentives, the One Big Beautiful Bill Act allocates $7.5 billion to the Department of Defense to strengthen munitions and supply chain resilience through direct critical minerals funding.

$2 billion to strengthen U.S. critical mineral stockpiles

$5 billion to strengthen U.S. critical mineral supply chains

$500 million to support credit for critical mineral industries

An additional $1 billion is appropriated under Section 50403, "Energy Dominance Financing” with funds remaining available through September 30, 2028.

An additional $1 billion is appropriated under Section 30004 of the Defense Production Act Appropriations, which will remain available until September 30, 2027.

The MP Materials–Department of Defense landmark transaction validates the federal government's willingness to invest, de-risk, and secure domestic supply chains directly. CTR's platform offers even broader strategic relevance:

Essentially shovel-ready geothermal and lithium production

Additional critical minerals and isotopes

Fully integrated downstream capabilities

Energy supply for defense-relevant infrastructure, including AI and hyperscale computing

Permitting and execution readiness

Rod Colwell at the White House

Together we are making a world of difference!

For over twelve years, CTR and the communities of Imperial County have worked together to build strong foundations for local jobs, a thriving economy, and a sustainable future.

In the past year, CTR's team has participated in over 120 community-led events, including 32 community and sponsored events, 11 community workshops, and 79 stakeholder workshops and meetings, each helping to build a stronger, more informed, and more engaged community.

CTR is proud to go even further, with a comprehensive Project Labor Agreement for Union construction and major maintenance jobs for all CTR’s projects.

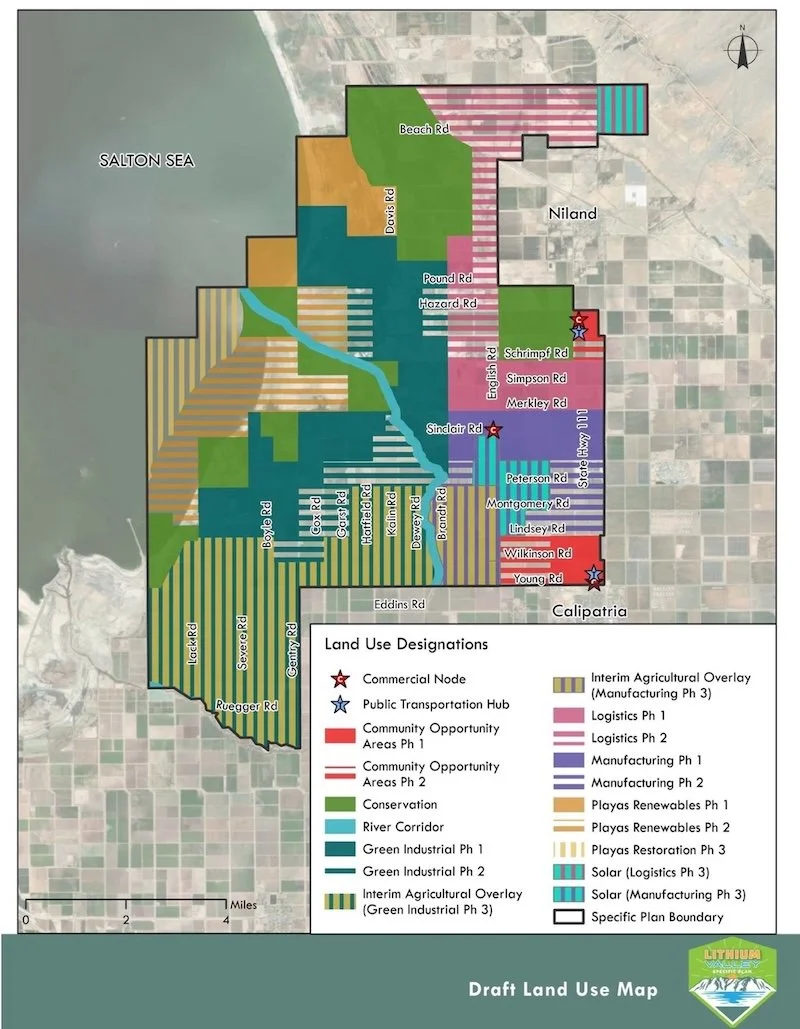

We applaud the County of Imperial for their efforts to advance the Lithium Valley Specific Plan - a comprehensive framework, spanning 51,000 acres, which will transform the Imperial Valley into a Sustainable Clean Energy, Advanced Manufacturing, and Data Industry Hub. Imperial County is the first county in the United States to purposefully design a development plan that includes sector-specific zoning, environmental and conservation corridors, infrastructure, agriculture, and community opportunity areas, to ensure responsible and sustainable development.

CTR supports these efforts at the local, state, and federal level.

Moving Forward

CTR’s refined structure continues to attract specialist development partners that provide opportunities to accelerate time-to-market for each product line while enabling CTR to capture multiple value streams with built-in optionality tailored to the interests of sector-specific investors focused on energy, minerals, and manufacturing.

This remains a highly dynamic period for CTR, with active negotiations and technical engagements progressing across multiple stakeholders.

We appreciate the leadership of our Board and the support of our shareholders as we continue to strengthen CTR's position with the new federal administration and execute Stage 1 development.

We would also like to thank the residents and community leaders in Imperial County for their support, encouragement, and engagement as we work together to build a dynamic, sustainable, and secure future for Imperial County and for the nation.

Best regards,

Rod Colwell

Chief Executive Officer

Note to Readers:

This communication contains estimates, predictions, opinions, projections and other forward-looking statements. Such statements that are not historical facts, including statements about the company's current beliefs or expectation of future events, are forward-looking statements, and you should not place undue reliance on them. Such forward-looking statements are based on various assumptions, many of which are beyond the control of management and are subject to risks and uncertainties and other factors which could cause actual results to vary materially from those currently anticipated and such variations may be material. These risks include, without limitation, risks associated with the development of the project and geothermal exploration and mineral extraction generally, commodity pricing and market volatility risks and risks associated with being able to access necessary capital and financing to develop the project. No representations or warranties are made by the company or any of its officers as to the accuracy of any such statements or projections. Certain statements contained within this communication including any documents, presentations, website links, reports, or other communications, may contain “forward-looking statements” within the meaning of applicable laws. These statements are based on current expectations, estimates, forecasts, and projections about our business, future performance, strategies, and plans, as well as assumptions made by management. Forward-looking statements typically include words such as "anticipate," "expect," "intend," "plan," "believe," "estimate," "project," "forecast," "likely," "may," "should," and similar expressions. These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, many of which are beyond our control and may cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may affect future results include but are not limited to; changes in market conditions; economic trends; changes in laws, regulations, or governmental policies; technological advancements; and other business risks detailed in our filings with regulatory bodies, if applicable. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.